But good inventory management can actually be just as effective in boosting your business’ profitability. Thank you for reading CFI’s guide to Inventory Turnover Ratio.Retailers are always looking for ways to increase their bottom line by boosting sales and making savings on overheads. Depending on the industry, the ratio can be used to determine a company’s liquidity.A low ratio implies poor sales, excess inventory, or inefficient inventory management.A high ratio is always favorable, as it indicates reduced storage and other holding costs.The ratio should only be compared for companies operating in the same industry, as the ratio varies greatly depending on the industry.Inventory turnover ratio is an efficiency ratio that measures how efficiently inventory is managed.

If a retail company reports a low inventory turnover ratio, the inventory may be obsolete for the company, resulting in lost sales and additional holding costs. For example, inventory is one of the biggest assets that retailers report. Unsold inventory can face significant risks from fluctuating market prices and obsolescence.ĭepending on the industry that the company operates in, inventory can help determine its liquidity. Low turnover implies that a company’s sales are poor, it is carrying too much inventory, or experiencing poor inventory management. The benchmark ratio varies greatly depending on the industry. It is vital to compare the ratios between companies operating in the same industry and not for companies operating in different industries. It is important to achieve a high ratio, as higher turnover rates reduce storage and other holding costs. Inventory turnover ratio is an efficiency ratio that measures how well a company can manage its inventory. Interpretation of Inventory Turnover Ratio In addition, it may show that Walmart is not overspending on inventory purchases and is not incurring high storage and holding costs compared to Target. It implies that Walmart can more efficiently sell the inventory it buys. Likewise, the ratio for Target is calculated as follows:īy comparing the inventory turnover ratios of Walmart and Target, two companies that operate mainly in the retail industry, we can see that Walmart sells its inventory 8.26x over a period of one year compared to Target’s 5.54x. The ratio for Walmart is calculated as follows: (WMT) and Target Corporation reported the following figures in financial statements: Practical Example of Inventory Turnover Ratioįor example, Walmart Inc. Note: an analyst may use either average or end-of-period inventory values.

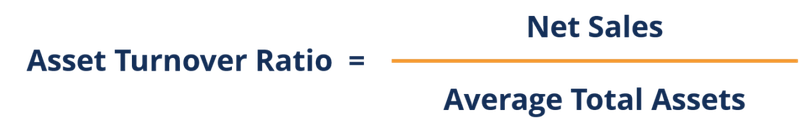

The inventory turnover ratio formula is equal to the cost of goods sold divided by total or average inventory to show how many times inventory is “turned” or sold during a period. The inventory turnover ratio, also known as the stock turnover ratio, is an efficiency ratio that measures how efficiently inventory is managed. Updated FebruWhat is the Inventory Turnover Ratio?

0 kommentar(er)

0 kommentar(er)